The Bitcoin Bubble Will Burst

Let me start with saying I love the concept of crypto, I’m not against it. I first bought in 2015 @ ~$300USD, with a peak holdings of 21 BTC which I progressively sold/spent on the way up.

I’ll summarise then go into detail why I believe Crypto will bust:

#1 It’s being ‘maliciously’ pumped

#2 It’s a pyramid scheme

#3 It will get outlawed

Hear me out before you flame me. Then, if you disagree, please tell me why.

#1 Bitcoin is Being ‘Maliciously’ Pumped by Funds for Easy Bonuses on Risky Upside 🤑

In short, I believe financial institutions are carelessly investing their clients money in crypto hoping it’ll rocket so that they can pay themselves fat commissions on the upside. If/when it crashes, the losses are borne by their clients (just like with the dot-com bubble of 2000 and mortgage-backed securities bubble of 2007).

It’s roughly analogous to investment funds buying lottery tickets with their clients’ savings; if it wins everyone wins, if it loses the client loses. Bitcoin is the simplest ticket to scratch (so-to-speak), and requires less effort to research than scouring through hundreds of companies annual reports.

As such, the primary push behind Bitcoin’s bull run from sub-$10k of 2020 to current >$60k USD is from investment funds (which is scary). The secondary push is a few small countries utilising it (which is great).

Most people thought funds investing into crypto was “great-confidence-boosting sign” for crypto, while I saw this as a “transfer-of-weath-coming-soon sign”.

You probably remember various Wall Street industry players were the same parties who were throwing their client’s savings at dot-com companies and mortgage-backed securities tools before those 2 bubbles burst.

As dot-com and real estate were performing prior to the bust, the fund managers/executives were getting the fattest commissions/bonuses ever. When the bubble eventually burst, all the losses were borne by the little guys whose savings went into these instruments prior to the bust.

1999: Why bust your ass researching sound/genuine prospects which grow 5%-10% a year, when you can chuck a hail-mary putting your clients savings into random dot-com stocks, get fat commissions/bonuses as they jump 50% or whatever, then when the bubble bursts, pass the losses to your client with a sad apology letter blaming “the market”.

2007: Why bust your ass researching sound/genuine prospects which grow 5%-10% a year, when you can chuck a hail-mary putting your clients savings into random mortgage-backed securities derivatives, get fat commissions/bonuses as they jump 50% or whatever, then when the bubble bursts, pass the losses to your client with a sad apology letter blaming “the market”.

2021: Here we are again, with the same greedy players, with a different song. We’ve been a little overdue for a bubble burst. Enter Bitcoin’s new all-time-high (“ATH”).

Every time a bubble bursts, there is a massive transfer of wealth from “those who bought in along the way up” to “those who cashed out around the top.

For the 1% to succeed with a proper transfer of wealth from the 99%, they need to sell their position before it bursts. Each winner selling 1 BTC @ $100k USD or whatever, would require 100x “losers” buying 0.01BTC for $1k, hoping itll hit $1M or whatever.

Think of the game Musical Chairs, which requires 9 people to lose for 1 person to win. I really see Bitcoin/crypto as financial musical chairs.

And guess who’s the DJ with crypto musical chairs? The US Federal Reserve. one day, they’ll decide to outlaw crypto (explained in 3rd section below), which would crash BTC to sub-$1k overnight. The politicians who know its coming will warn their billionaire-buddies who will dump first. You or I probably wont be receiving the call. We’ll probably just wake up one day and Bitcoin will be like $500 or whatever.

#2 Bitcoin is a Pyramid Scheme That’s Reached ‘Diminishing Return’ 📉

Investopedia: a pyramid scheme funnels earnings from those on lower levels of an organization to the top, relying on profiting from recruitment fees and seldom involve the sale of actual goods or services with intrinsic value (sounds like crypto lol)

Oxford Dictionary: a form of investment in which each paying participant recruits two further participants, with returns being given to early participants using money contributed by later ones (also sounds like crypto)

While investing at its core can be loosely analogous to a pyramid scheme (buying into something which depends on other people buying in later to make the value go up), it applies moreso to crypto because it has little genuine practical use.

Below I outline 4 key reasons why I feel crypto in general is inherently a modern pyramid scheme:

1) Risk Rises Exponentially

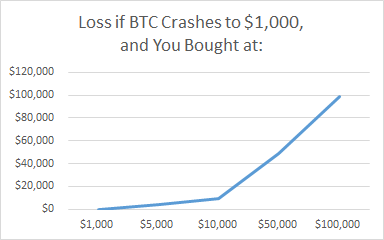

Putting it simply, the higher Bitcoin goes, the riskier it becomes to hold, as it is more likely to go down than up (more detail below).

When Bitcoin is like $1k, its entire market cap is lighter, meaning increases are viable. IF (IF) Bitcoin is like $1M, its market cap would be $18 trillion, which becomes exponentially more difficult for it to “10x”, so why would anyone buy at $1M? Or $900k? or $500k, for that matter? Why be the last person to join a pyramid scheme, when there’s no one to sell to after you join for a profit?

2) Returns Shrink Exponentially

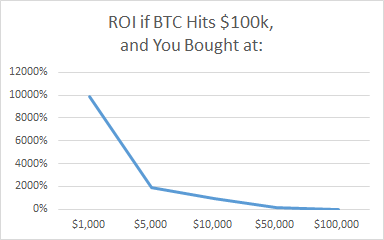

The higher Bitcoin goes, potential return drastically decreases. You know those stories about people who invested $1,000 when it was $10 and are now sitting on $7M worth of BTC @ $70K/BTC (100,000x return)? Cool story bro, but it wont happen again now.

At best, you may see 10x return from $70k to $700k — and even that is extremely unlikely! It will not 100,000x again, it will not even 100x again. Your $1k will not turn into $7M, or $700k, or $70k.

Like a pyramid scheme, the astronomical gains were for the earliest investors at $0.10, or $1, or $100 even. Astronomical gains will not occur from $70,000/BTC. The market cap is just too heavy.

3) Difficulty of Increase Rises Exponentially

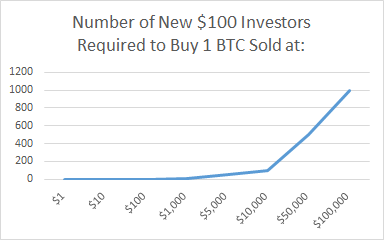

Similar to #1/#2, but another perspective. The more expensive Bitcoin becomes, the more “new members” the pyramid scheme requires for an early adopter to exit.

When BTC went from $1 to $10, a single new investor with $100 would allow 10x people to cash out 1BTC each.

When BTC went from $100 to $10,000, a single new investor with $100 would make a small dent — it would take 100 new members investing $100 each to enable 1x person to sell 1BTC.

IF (again, IF) BTC reaches $1M, it would requires 10,000 people to invest $100 each, for 1x person to sell 1 BTC.

I think you get the idea here; the more expensive Bitcoin becomes, the harder it becomes for people to exit at a worthwhile gain.

Potential risks are very high, potential gains are very small.

4) Most are Investing for Speculative Gain [not actual use]

This one’s simple .. Pretty much everyone who has invested into crypto is purely in it hoping to sell their crypto to the next person for more.

It’s like .. Buying the currency of Antarctica .. Whatever currency it is that they use there (lol) .. Knowing that 99% of people who buy it wont ever go to Antarctica .. And you’re hoping that it will go up in value?? That’s Bitcoin.

Altcoins are like the currency of remote islands that no one knows where they are lol.. Extremely volatile and risky, very pump-and-dump oriented. BTC and ETH have the most merit IMO (for survivability and use, respectively). The rest are hype/fluff, don’t even bother.

#3 Bitcoin Will Get Outlawed ❌

Lastly, I’m betting Bitcoin will be outlawed by an increasing number of nations, including eventually USA (which may be the death of the BTC specifically). I believe this is inevitable, sadly.

Have you noticed its increasingly difficult to withdraw large amounts of cash from the bank? If you ever tried to withdraw say $10k, you’ll notice its shockingly difficult. This is Australia restricting AUD, this is America restricting USD, this is countries restricting their own physical currency!

Why are countries restricting the use of their own physical currency? So they can track/tax/control the movement of money better.

Tracking, taxing, and controlling Bitcoin is between difficult and impossible.

When a person does something wrong, the courts want to be able to “seize” their assets/cash/accounts. Like the gym owner in the US who refused to close his gym for lockdowns, the courts seized his $200k bank savings for his legal defence funds. If the guy had $200k in crypto, they would NOT be able to do this. Governments will NOT allow people to hold currency which they cannot seize at will.

As such, Bitcoin will eventually be outlawed in favour of some sort of E-USD / Digital-Dollar cryptocurrency launched by the US Federal Reserve themselves, which will be engineered in a manner which gives them the ability to comfortably track, tax, and control at will (like Ecuador, China, Singapore, and others have already done).

Conclusion 🤔

So yeah, if you’ve taken the time to read my justification, I really appreciate that! Let me know your thoughts in the comments? I’m truly happy to discuss the topic.

If I’m wrong about anything, feel free to bring it to my attention and I’ll make the relevant corrections. Peace!