Australian Real Estate Bubble

I’m often asked what I think about investing in real estate..

In short, I strongly believe it is overpriced.

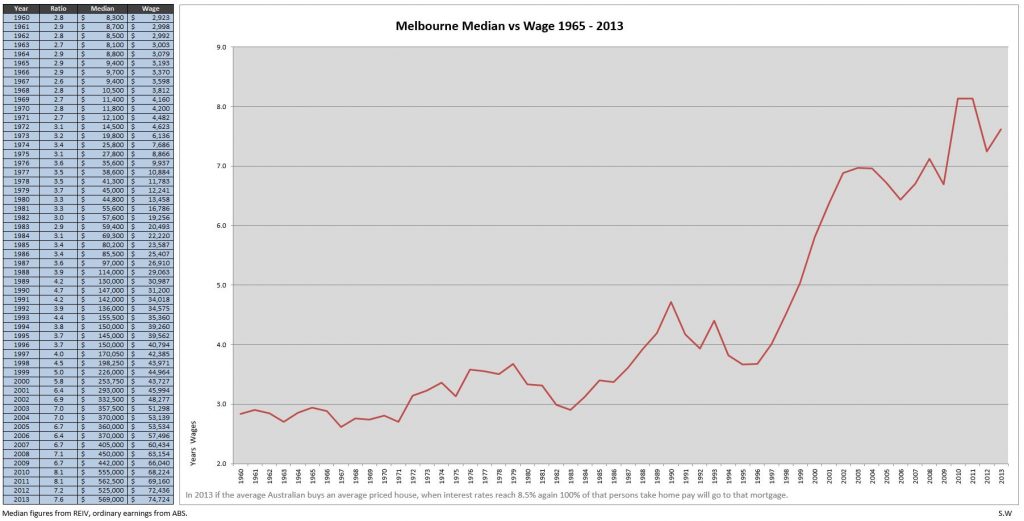

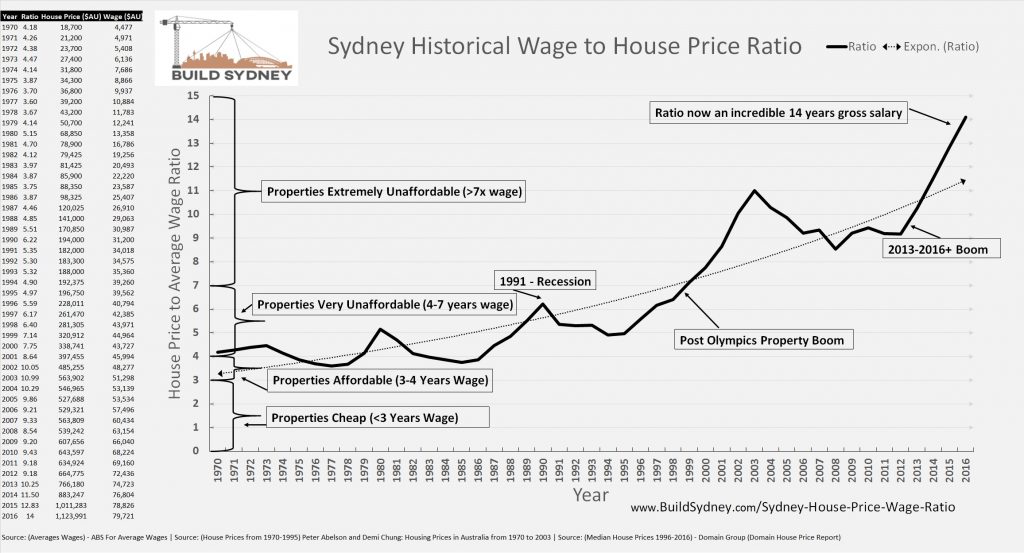

We are currently facing the largest disparity between wages and property prices in historical record:

In 1970, median Melbourne house price was 3x the median annual wage

In 2013, median Melbourne house price was 8x the median annual wage

In 1970, median Sydney house price was 4x the median annual wage

In 2016, median Sydney house price was 14x the median annual wage

This means the median house which used to cost 4-years wage in the 1970s now cost 14-years wage, or basically 3.5x harder to purchase based on market price.

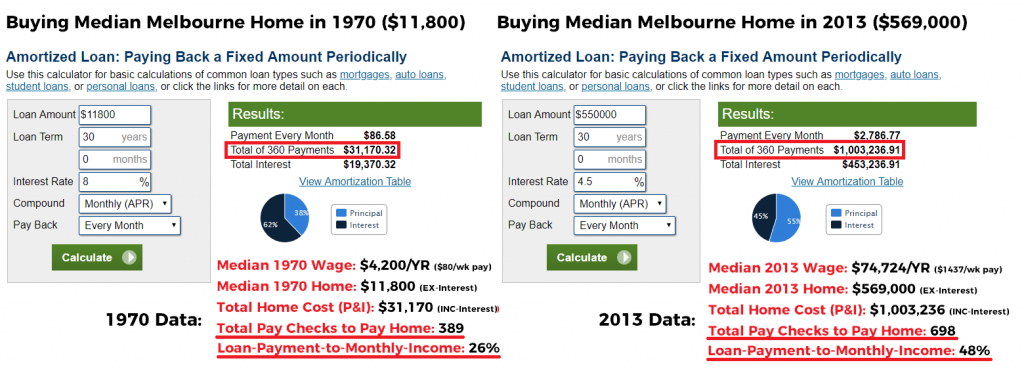

Some might argue “but interest rates have dropped!”, which is true.. However, follow the money and you’ll see that simple math proves the median home is still twice as difficult to afford in present times than 1970s;

In 1970, median mortgage repayment was 26% of the median wage

In 2013, median mortgage repayment was 48% of the median wage

In 1970, the median monthly mortgage was basically covered by a SINGLE week’s pay check from the median monthly wage. By 2013, the median monthly mortgage took TWO median wage weekly pay checks to cover! 😱

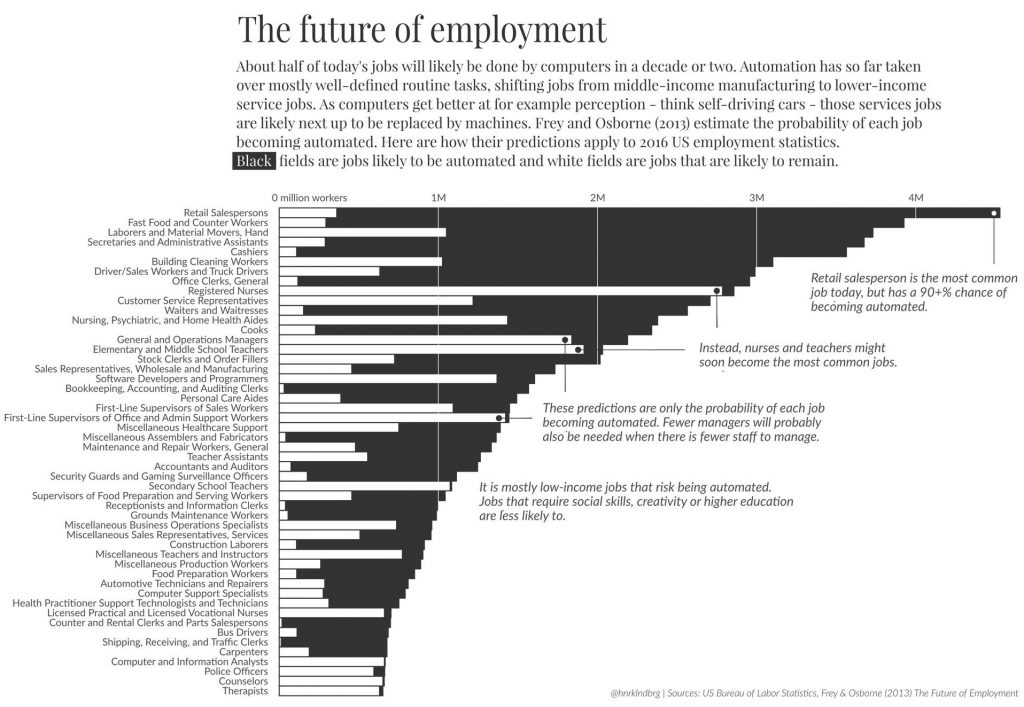

Keep in mind wages aren’t rising like they used to. Any job which becomes too expensive is typically replaced by AI/software/tech/robots/outsourcing. As such, job security was far stronger in the 1970s than present times.

Numerous statistics from various sources show that most jobs will be cannibalized by automation within 10-20 years;

Uber drivers? All replaced by self-driving cars.

UberEats deliveries? All replaced by delivery drones.

Retail & fast food checkout? Mostly replaced by robots.

Most jobs I can think of will be gone in 10-20 years.. Scary!

So tell me, how will all these people pay their mortgages (or rent, for that matter)? If you think the house you just bought for $500k is going to hit $1M in the next 5-10 years, tell me who is going to pay for it, and how?? Maybe a robot 🤖🤷♂️

(PS, feel free to leave a comment below if you agree/disagree, I’d be happy to hear your thoughts!)

Spot on if you ask me